By Alec Smith, Max Goldstein and Neil Singh

The small nation of Djibouti is rapidly becoming a focal point for great power competition in Africa, particularly in the naval domain. As piracy in the Horn of Africa became a point of international concern in the late 2000s, a flurry of international players took interest in Djibouti as a host for counter-piracy operations. Even as the threat of piracy declines, Djibouti remains an enticing location for bases, as it is located between the Red Sea and the Gulf of Aden. In this report, we use satellite imagery to show the growing interest in Djibouti. China, America, France, Italy and Japan operate military bases in close proximity to each other in Djibouti, making it a key country to understand the nature of great power competition in Africa, the Middle East, and the Indian Ocean.

Key Judgement-1: Despite expanding, US presence in Djibouti likely only supports limited operations compared to other US overseas bases for the next 12 months

Key Judgement-2: It is likely that US allies will expand their maritime security operations in Djibouti due to heightened geopolitical tension and security crises in the region in the next 12 months.

Key Judgement-3: It is highly likely that Beijing will reorient anti-piracy efforts into grand strategy maritime influence operations in the next 12 months.

Sources of Geospatial Analysis

- Google Earth

- Esri

- Earth Star Geographics

- Maxar

- Sentinel-1 L2A

Key Judgement-1: Despite expanding, US presence in Djibouti likely only supports limited operations compared to other US overseas bases for the next 12 months.

a) American equipment stationed at Camp Lemonnier provides localized maritime responses to security concerns. For instance, the SeaArk Dauntless 34 is explicitly designed as a “Patrol/Police/Security” platform, with limited open water capabilities [source], [source], [source].

b) At least 16 MV-22B Ospreys are based at Camp Lemonnier as of 27 April 2023. Each is capable of carrying 24 to 32 fully equipped soldiers into battle, or approximately 4.5 metric tons of cargo (10,000 pounds) [see Fig.1].

c) This amounts to a total potential combat force of 384-512 Marines, potentially supported by HMMWVs and towed artillery. While capable of responding to small-scale events within 500 nautical miles of Camp Lemonnier, it is unable to conduct large-scale operations in the same way larger U.S. bases, such as Ramstein AFB or Diego Garcia can [source].

d) The presence of C-130 Hercules Aircraft, at least 14 as of 27 April 2023, is indicative of the logistical importance of Camp Lemonnier. C-130s form the backbone of American aerial logistical efforts [source] [see Fig. 1].

f) This last point is further supported by what are likely three KC-135 Stratotankers. These are essential in providing aircraft with the capability to perform their mission urther afield and for longer periods of time. These platforms offer a solution to the “Tyranny of Distance” [see Fig. 1].

g) VIP transports, including a C-40 Clipper and at least four C-12 Huron’s further the analysis presented above. These aircraft are being used to facilitate liaison efforts between the American military and regional partners, including in Africa and the Persian Gulf [source].

h) Two P-3 Orion aircraft, used in maritime surveillance and anti-submarine operations, are present as of 27 April 2023. These are likely used to monitor PLAN activity in the region and support counter terror operations against Al-shabaab by provinding SIGINT to targeteers and troops on the ground. [see Fig. 1].

i) The notable lack of significant numbers of combat aircraft, and the scant personnel numbers (approx. 4000) indicate Camp Lemonnier is exclusively used for counter terror operations and monitoring PLAN activties. [source].

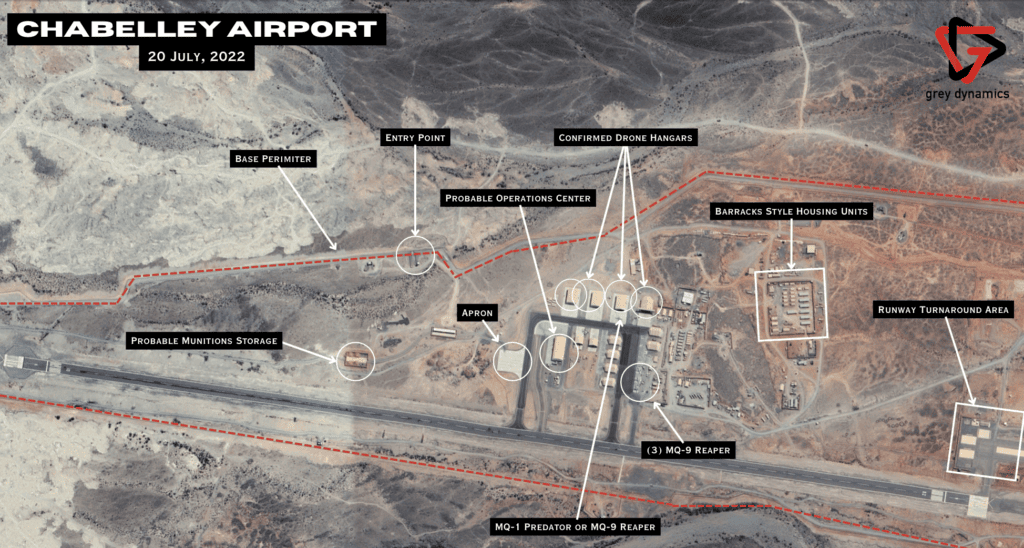

j) The US is expanding its drone base at Chabelley Airfield, which is also utilized by partner nations such as Italy. Satellite imagery reveals additional hangars added to the complex after 2019 likely to support operations in Somalia. [source], [see Fig. 2, Fig. 3].

Name: Camp Lemonier Overview

Location: 11°32’36.97″N, 43° 9’43.76″E

Description: A large US military installation built into the southern portion of Djibouti’s main airport. The base hosts US Marine elements as well as multiple types of aircraft such as AC-130s and MV-22 Ospreys. The base underwent extensive development recently, with the addition of new residential and recreational areas as well as flight facilities.

Name: Chabelley Airfield Overview

Location: 11°31’10.15″N, 43° 4’7.54″E

Description: A moderately sized air base primarily used for UAV operations by the United States and Italy. Several new hangars were constructed to house these drones. The base is located to the southwest of Camp Lemonier.

Name: Chabelley Airfield Expansion

Location: 11°31’10.15″N, 43° 4’7.54″E

Description: An animated representation of the development of Chabelley over the course of several years.

Key Judgement-2: It is likely that US allies will expand their maritime security operations in Djibouti due to heightened geopolitical tension and security crises in the region in the next 12 months.

a) MEPs from the EU Parliament’s Security and Defense Subcommittee (SEDE) visited Djibouti and Somalia in April. The SEDE chairwoman stated that the EU’s role in Djibouti should be continued and strengthened [source].

b) EU NAVFOR Atalanta conducted a trilateral exercise with Djiboutian and Japanese Naval units last May [source].

c) The French aircraft carrier Charles de Gaulle and carrier strike group made a stop in Djibouti in January. France hosts German and Spanish military units at its facilities [source], [source].

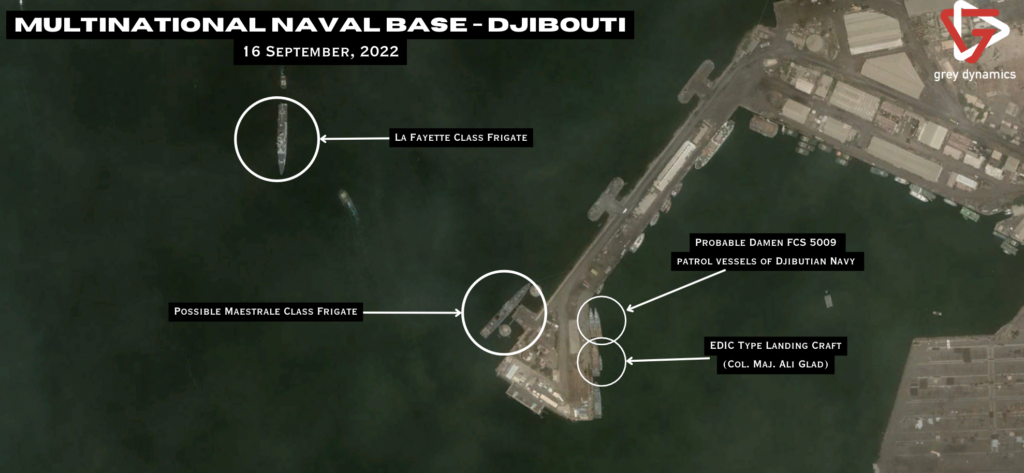

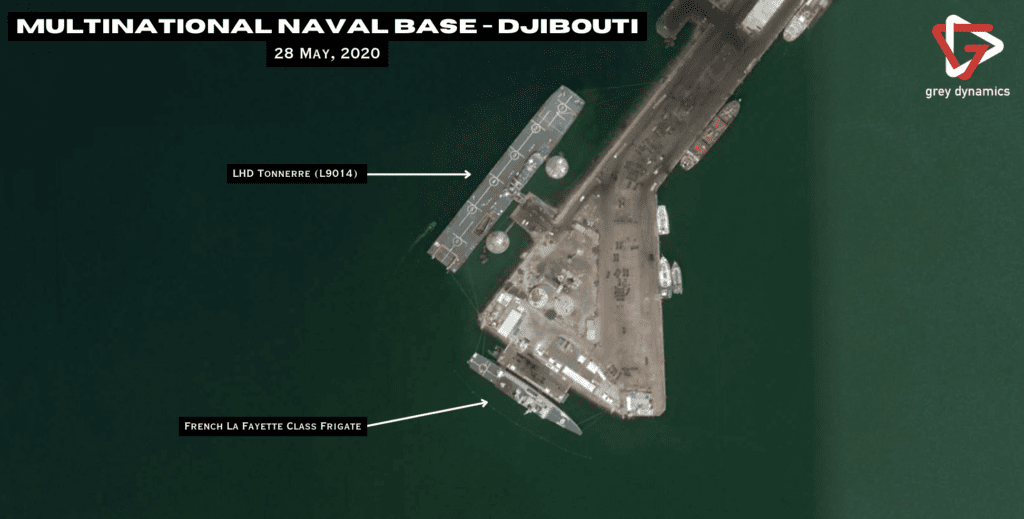

d) Satellite imagery shows a French Mistral Class Amphibious Assault ship docked at the port facilities in Djibouti [see Fig. 6].

e) The presence of a French Mistral Class amphibious assault ship could indicate an intention to project a more forceful maritime security presence in the Gulf of Aden [see Fig. 6].

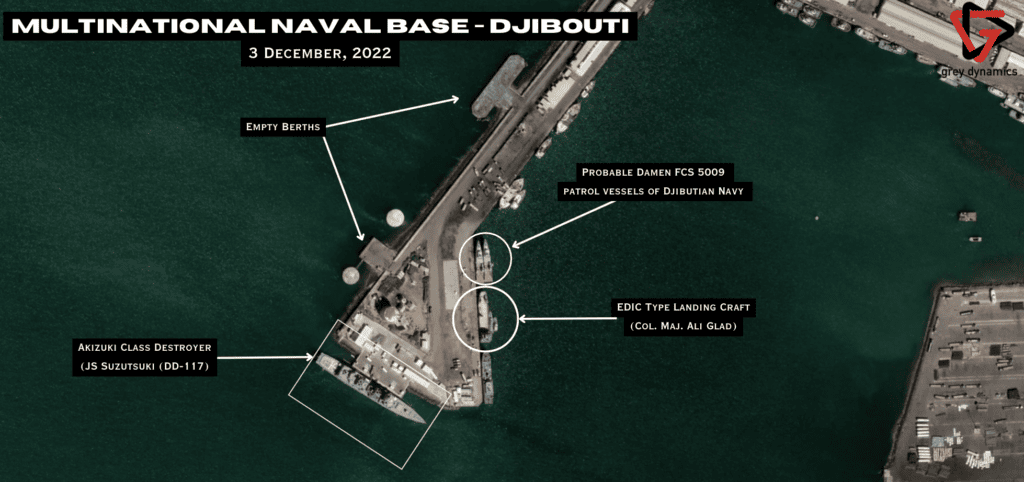

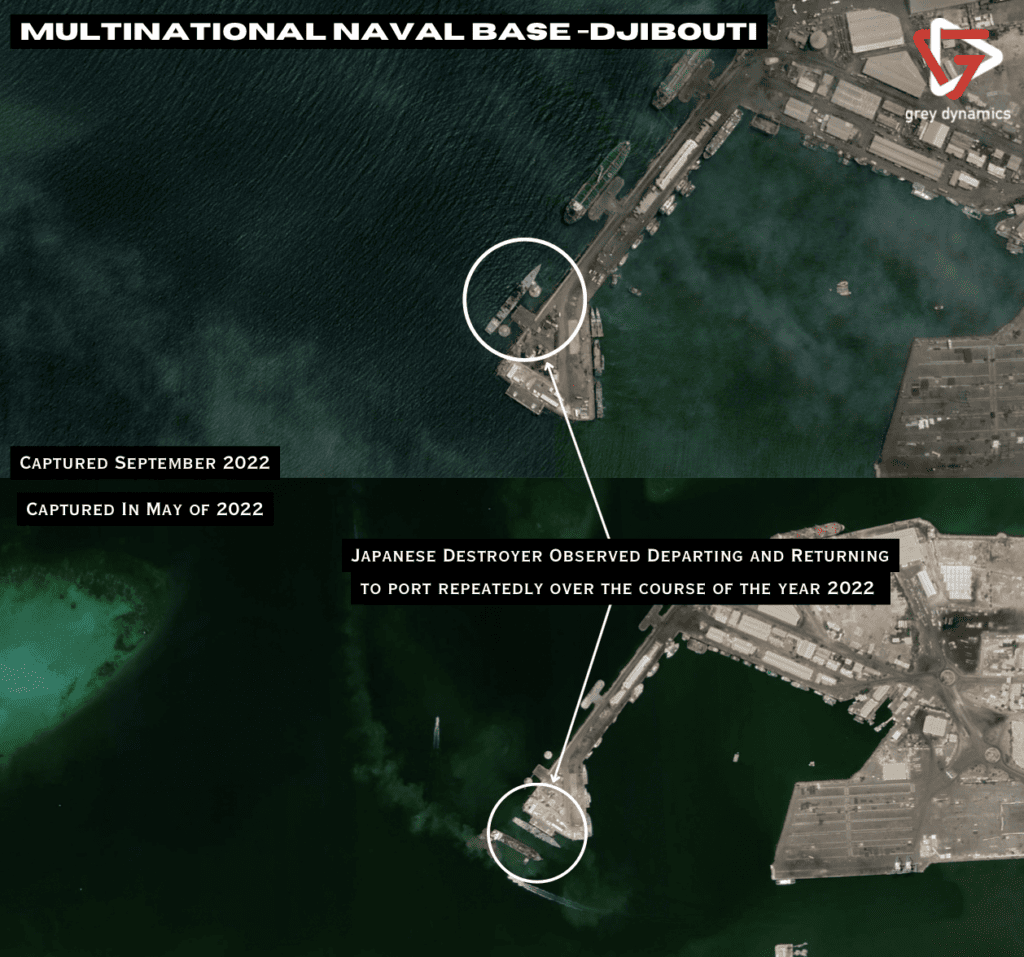

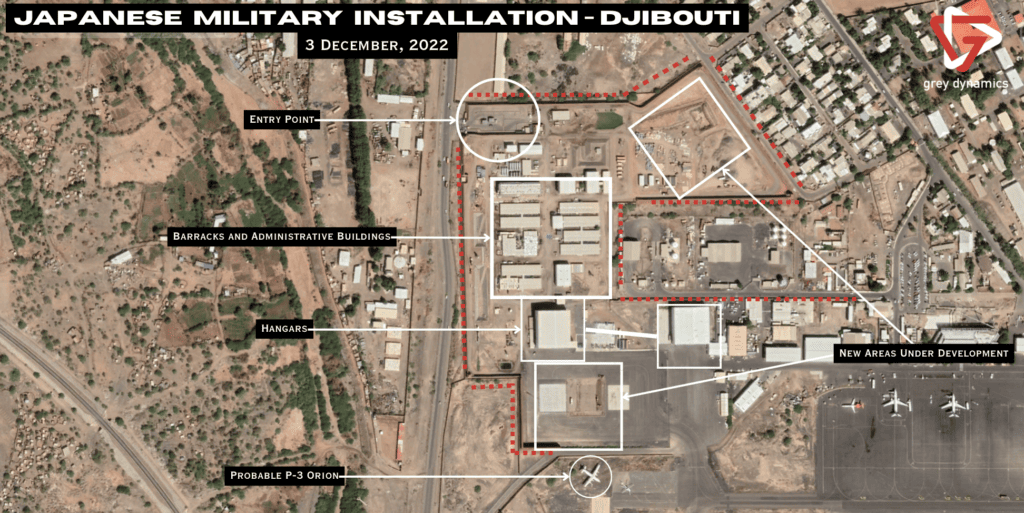

f) Satellite imagery shows a probable Japanese Akizuki Class Destroyer repeatedly departing and arriving back at the port in Djibouti, indicating that Japanese naval forces continuously operate in the Gulf of Aden [see Fig. 4, 7].

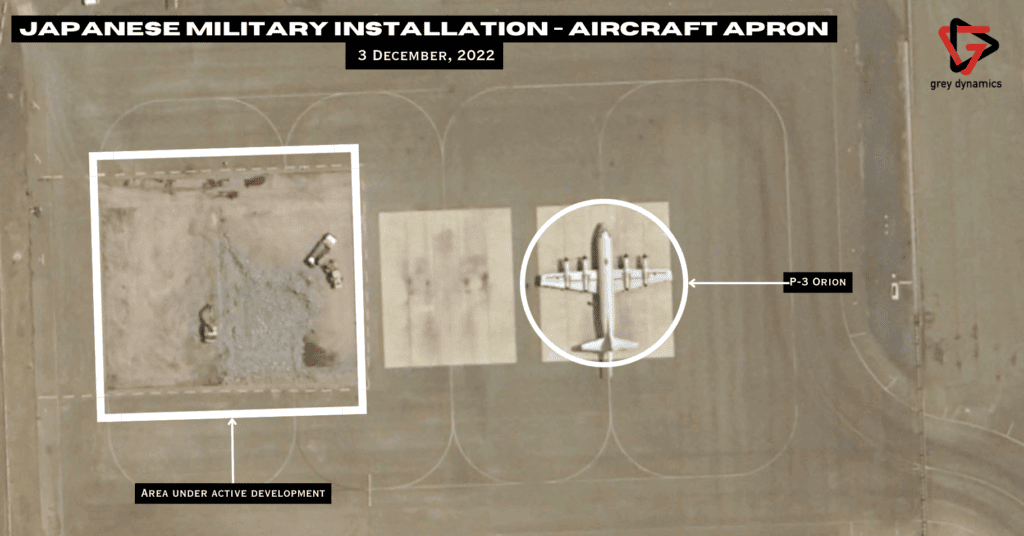

g) Satellite imagery indicates that Japanese facilities in Djibouti are undergoing an expansion which began in late 2022 [see Fig. 9].

h) The importance of a military presence in Djibouti was illustrated for both Italy and Japan when both countries used military facilities in the country to evacuate their nationals from Sudan [source], [source].

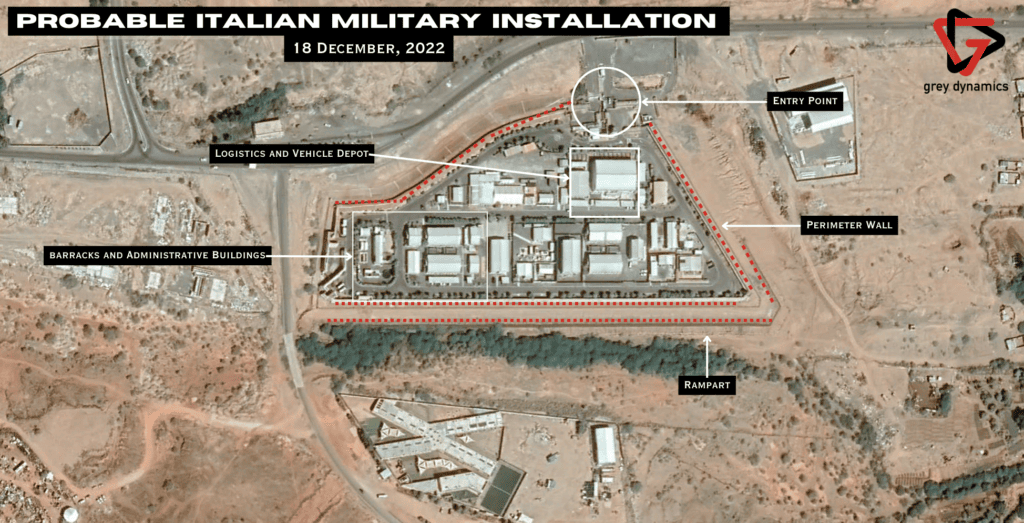

i) The Italian base in Djibouti is comparatively small but hosts special forces brigades alongside naval infantry intended to protect shipping from piracy [source], [see Fig. 8].

Name: Port of Djibouti Naval Base – December 2022

Location: 11°36’19.72″N, 43° 7’50.85″E

Description: An outward-facing port facility located at the northern portion of the Port of Djibouti. The Djiboutian Navy appears to utilize the berthing on the right-hand side, while multiple foreign naval vessels dock on the left and bottom portions of the wharf. A Japanese destroyer is visible in this capture.

Name: Port of Djibouti Naval Base – September 2022

Location: 11°36’19.72″N, 43° 7’50.85″E

Description: An outward-facing port facility located at the northern portion of the Port of Djibouti. The Djiboutian Navy appears to utilize the berthing on the right-hand side, while multiple foreign naval vessels dock on the left and bottom portions of the wharf. French and probable Italian naval vessels are visible in this capture.

Name: Port of Djibouti Naval Base – 2020

Location: 11°36’19.72″N, 43° 7’50.85″E

Description: An outward-facing port facility located at the northern portion of the Port of Djibouti. The Djiboutian Navy appears to utilize the berthing on the right-hand side, while multiple foreign naval vessels dock on the left and bottom portions of the wharf. A French frigate and an amphibious assault ship are present in this capture.

Name: Port of Djibouti Naval Base – May – September 2022

Location: 11°36’19.72″N, 43° 7’50.85″E

Description: An outward-facing port facility located at the northern portion of the Port of Djibouti. The Djiboutian Navy appears to utilize the berthing on the right-hand side, while multiple foreign naval vessels dock on the left and bottom portions of the wharf. Japanese naval assets are observed departing and returning in the capture.

Name: Probable Italian Base – BMIS

Location: 11°31’41.52″N, 43° 8’44.88″E

Description: A small Italian operations base located directly to the south of Camp Lemonier. The base hosts Italian military personnel who conduct maritime security operations.

Name: Japanese Military Instalation – Djibouti

Location: 11°33’12.17″N, 43° 8’40.56″E

Description: A Japanese military installation located to the north of Camp Lemonier. The base underwent development and expansion to house more military personnel. This base also hosts a contingent of P-3 Orion aircraft. The probable P-3 Orion in this capture may well not be a P-3 Orion. For a confirmed image of a Japanese P-3 Orion, please see the annex.

Key Judgement-3: It is highly likely that Beijing will reorientate anti-piracy efforts into grand strategy maritime influence operations in the next 12 months.

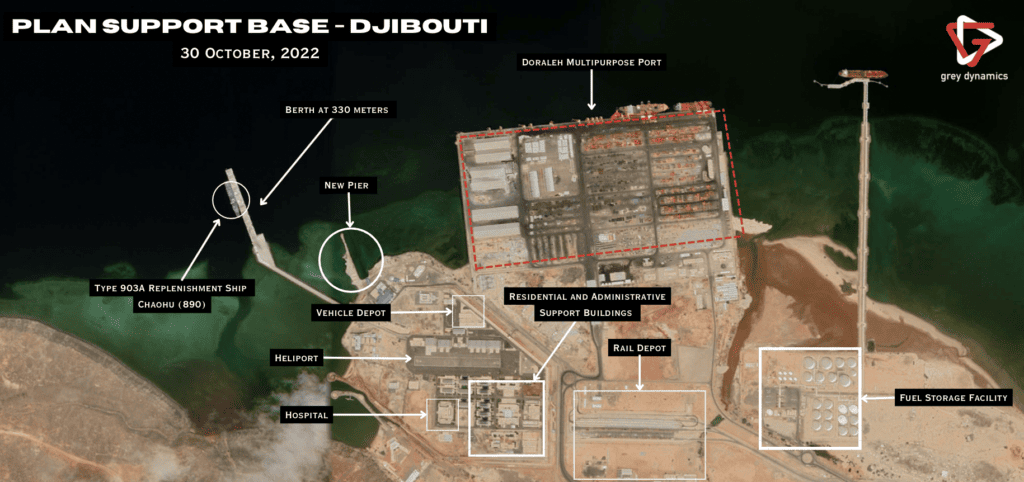

a) The People’s Liberation Army (PLA) Support Base in Djibouti organized and trained its military contingent for air, sea and land combat operations since 2016 [source].

b) This contingent is reinforced with mechanized and armour assets, armaments well beyond the scope of counter-piracy equipment [see Fig. 9]

c) Annual piracy incidents are at nearly less than half the incident rate they were in 2016 when the PLA Support Base in Djibouti began construction. Most pirate activity has now shifted to Southeast Asia and Latin America, with industry specialists claiming that piracy in and around the Gulf of Aden is “no longer a threat” [source] [source].

d) PRC officials have described the base as a “strategic strongpoint” more recently, speaking less of ongoing counter-piracy activity in the region through the base [source].

e) The naval base’s specifications are large enough to support the presence of the PLA Navy’s (PLAN) aircraft carriers, the Liaoning or the Shandong with berthing space of around 320 metres on both sides of its extended dock [see Fig. 9].

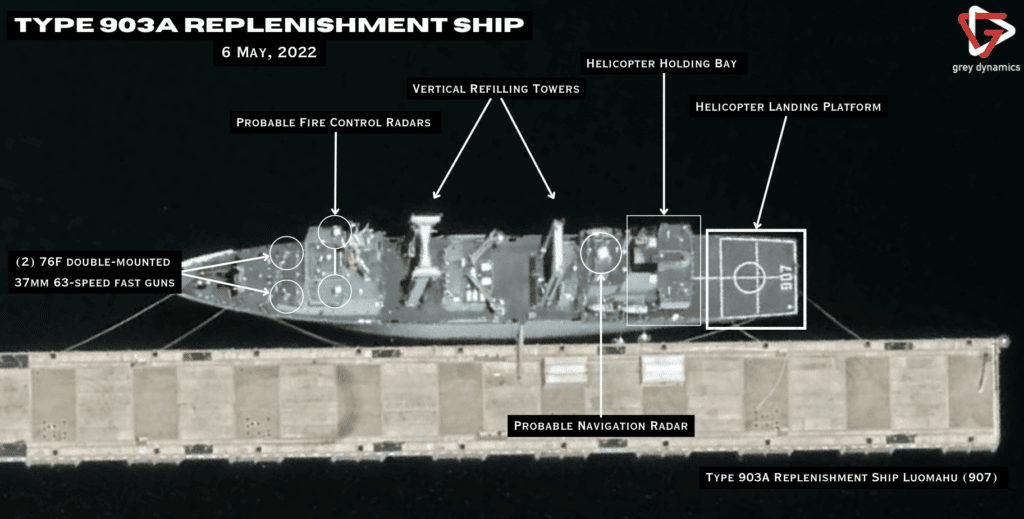

f) Vessels of the 40th Escort Task Force have been seen docking at the base with frequency, consisting of the Type-903A replenishment ship, the Luomahu (907) [see Fig. 10], the Type-052D class guided-missile destroyer Hohhot (161), and the Type-054A class frigate Yueyang (575) [source].

g) Additional vessels have been seen conducting operations further in the Indian Ocean via the use of the base in Djibouti, such as the Yuan Wang 5 intercontinental ballistic missile tracking ship arriving to dock in Sri Lanka [source].

Name: PLAN Support Base – Djibouti

Location: 11°35’50.89″N, 43° 3’17.08″E

Description: A moderately sized naval support base for PLAN operations in the western Indian Ocean. A large cargo terminal built with Chinese investment capital is located to the north of the base and a rail line terminates at the terminal with service to Ethiopia. A large pier hosts PLAN vessels and an additional one is under construction directly next to the pier.

Name: Type 903A Replenishment Tanker Luomahu (907)

Location: 11°35’50.89″N, 43° 3’17.08″E

Description: Type 903A Replenishment Tanker Luomahu (907) docked at the PLAN support base in Djibouti. The Type 903A tankers can be used to extend the ability of a fleet to remain at sea for much longer.

Analytical Summary

We have a high level of confidence in our assessment that US military operations in Djibouti are expanding and will retain the original mission profile that the United States initially announced at the beginning of the decade. The presence of new modular barracks, the expansion of aircraft aprons and the addition of new hangars at Chabelley all substantiate this assessment. However, successive US administrations could adopt a radically different approach to US foreign policy, and much of the political oxygen in the current foreign policy dialogue on Capitol Hill revolves around to what extent should the United States act as a globally preponderant superpower. As such, the possibility of a contraction of the US presence in Djibouti cannot be ruled out past 2024.

We have a similarly high degree of confidence in our assessment that US partner nations will continue to expand their operations in Djibouti. Both the EU and the Japanese have foreign policy objectives which are not intertwined fully with the United States, such as the protection of shipping lanes and the ability to rapidly evacuate civilians from dangerous areas. The ongoing need to dent piracy in an area of the world where several vital SLOCs pass through will continue to be a pressing concern for European and Asian nations.

We do not have a similarly high degree of confidence in our assessment that China is shifting the profile of its military forces in Djibouti. While Africa is an important piece of Xi Jinping’s Belt and Road Initiative, it is highly circumspect to speculate on the intentions of Beijing. Accordingly, we are only able to ascertain Chinese intentions based on the present equipment viewable through geospatial data.

Annex