Tanzanian Gold Mining

Gold exports generate 51.4% of Tanzania’s non-traditional export goods, due to series of reforms to the 2010 Tanzanian Mining Act. “A mineral right holder shall give preference to goods which are produced or available in Tanzania and services which are rendered by Tanzanian citizens and or local companies.” This ensures mining companies must give preference to Tanzanian companies and citizens. Under this regulation, non-Tanzanian companies must enter a joint venture arrangement (Barrick Gold) with the government. The setup of mineral hubs reduced the small and medium scale miner’s capacity for evasion of tax and mineral smuggling.

Key Judgments

- The mining reforms initiated by President Magafuli have resulted in an increase in tax revenue and extraction from mining operations. Minerals such as gold have seen a significant increase in extraction and a deal with Barrick Gold is likely to increase revenues as a settlement has been reached.

- Despite negative foreign investment ratings by companies such as Moody’s, according to the 2019 World Investment Report of CNUCED, investment has significantly increased from $938 million in 2017 to $1.1 billion in 2018. In the event of a decrease in Western investment, China will almost certainly seek to explore investment opportunities and has already communicated this.

The Evidence

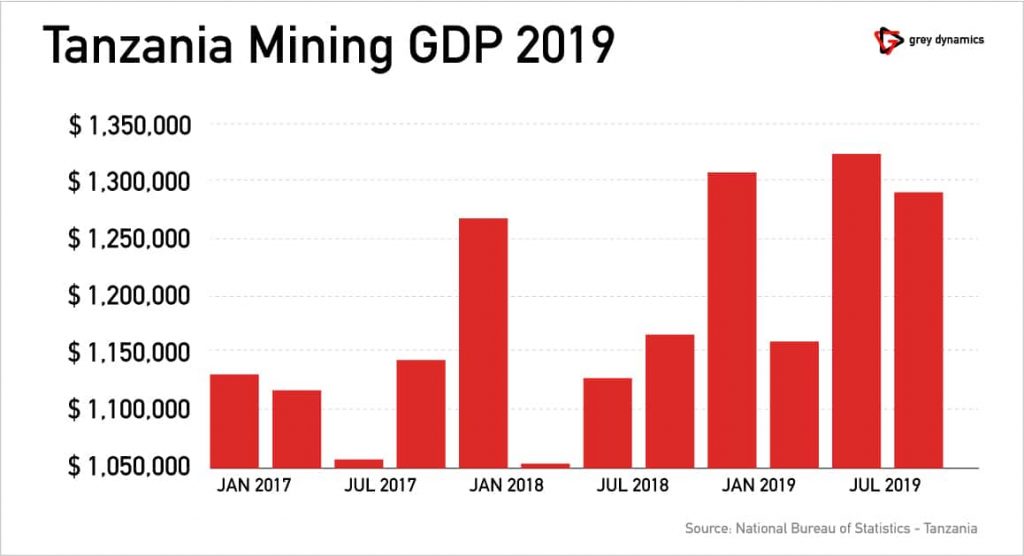

The Bank of Tanzania’s Monthly Economic Review stated gold exports significantly raised from $1.407 billion in October 2018 to $2.087 billion in October 2019. This is an increase of 48.3% in one year. The new joint venture agreement with Barrick Gold will benefit Tanzania with a $300 million settlement for previous disputes, while providing a 50/50 split in revenues which will be substantial. Barrick Gold is recruiting Tanzanian nationals, replacing expatriate workers, which directly benefits Tanzanians.

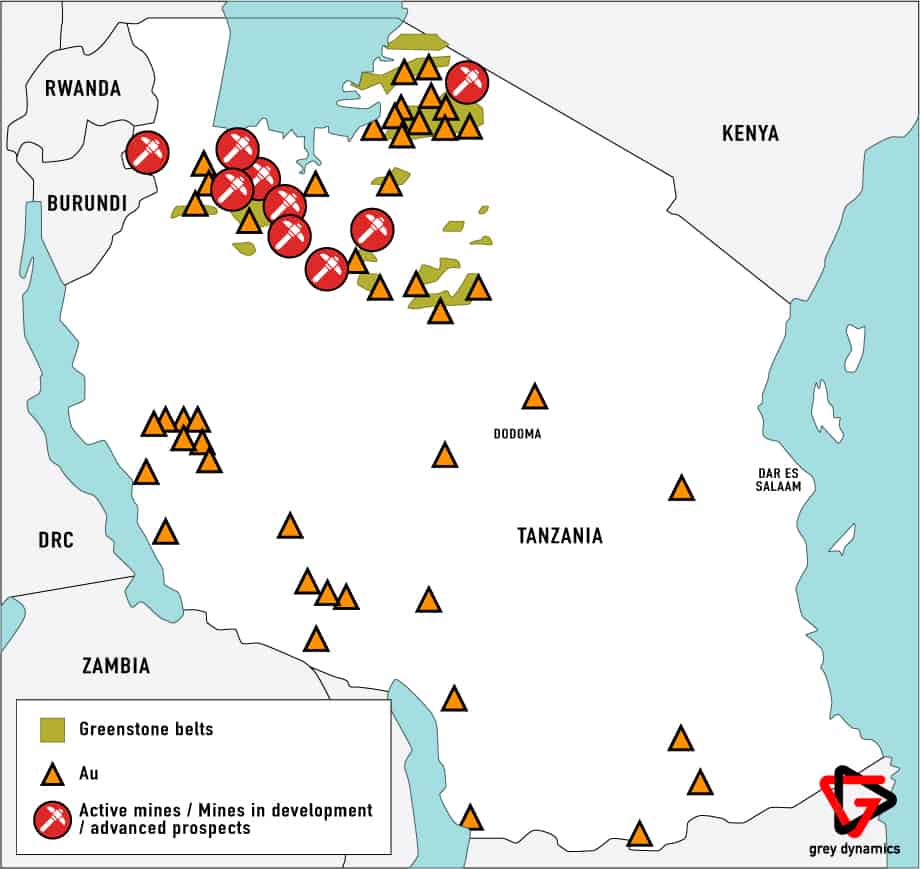

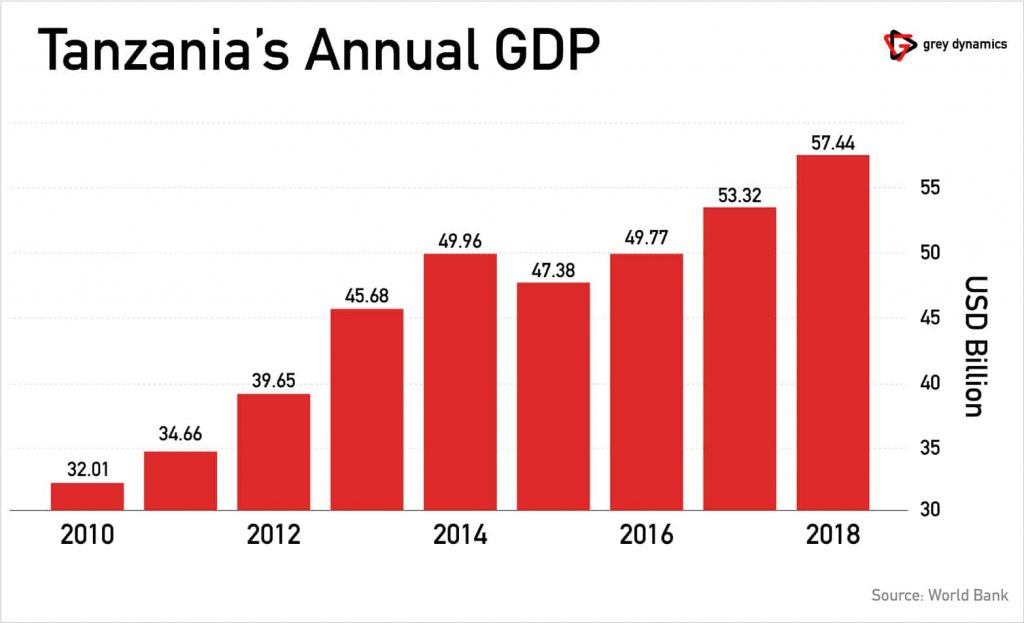

The mining sector has increased the contribution to GDP to 5% 2018/19, an increase from 4.8% last year. In the 2018/19 end of the fiscal year, projected income was $134.5 million. The government targets $205.5 million for the 2019/20 financial year. The World Bank 2019 Doing Business Report ranked Tanzania 144th out of 190 countries. Down seven from their previous report. Despite this, Tanzania has a viable source of foreign investment opportunities in China and Russia if current investment was to decrease.

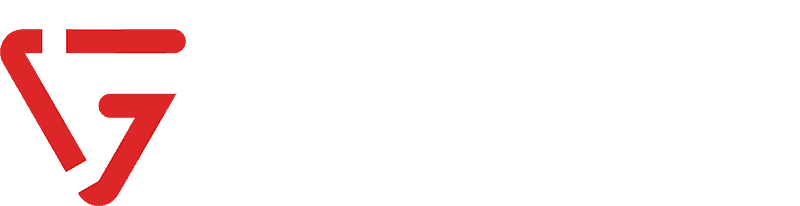

Tanzanian Gold Deposits and Mines 2015

Tanzanian Mining GDP 2019

Tanzanian Export

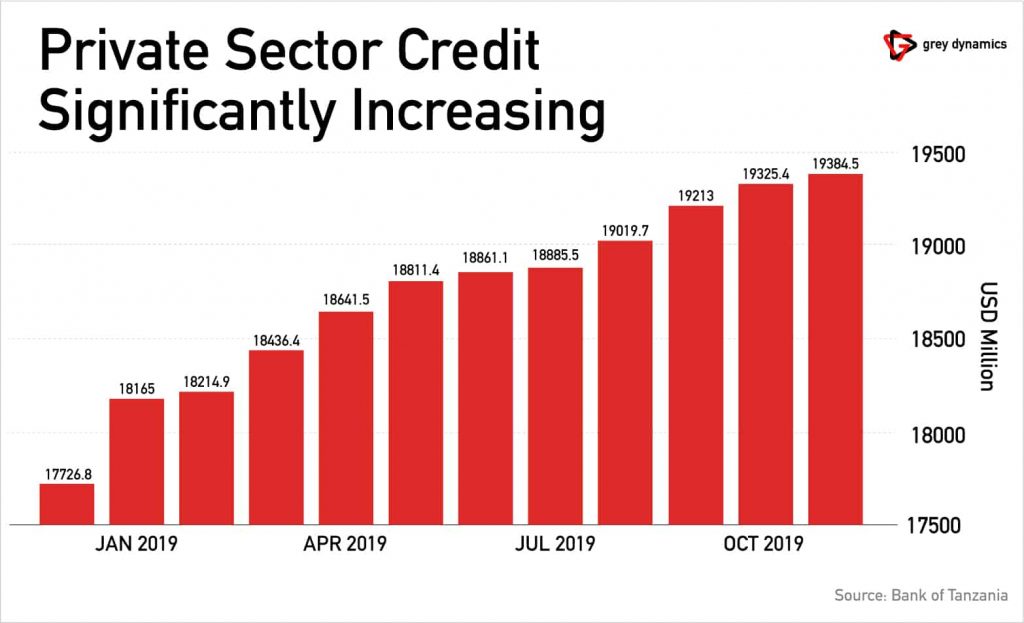

Tanzanian Private Sector

Tanzanian Annual GDP

Image: Mining.com / Acacia Mining (link)