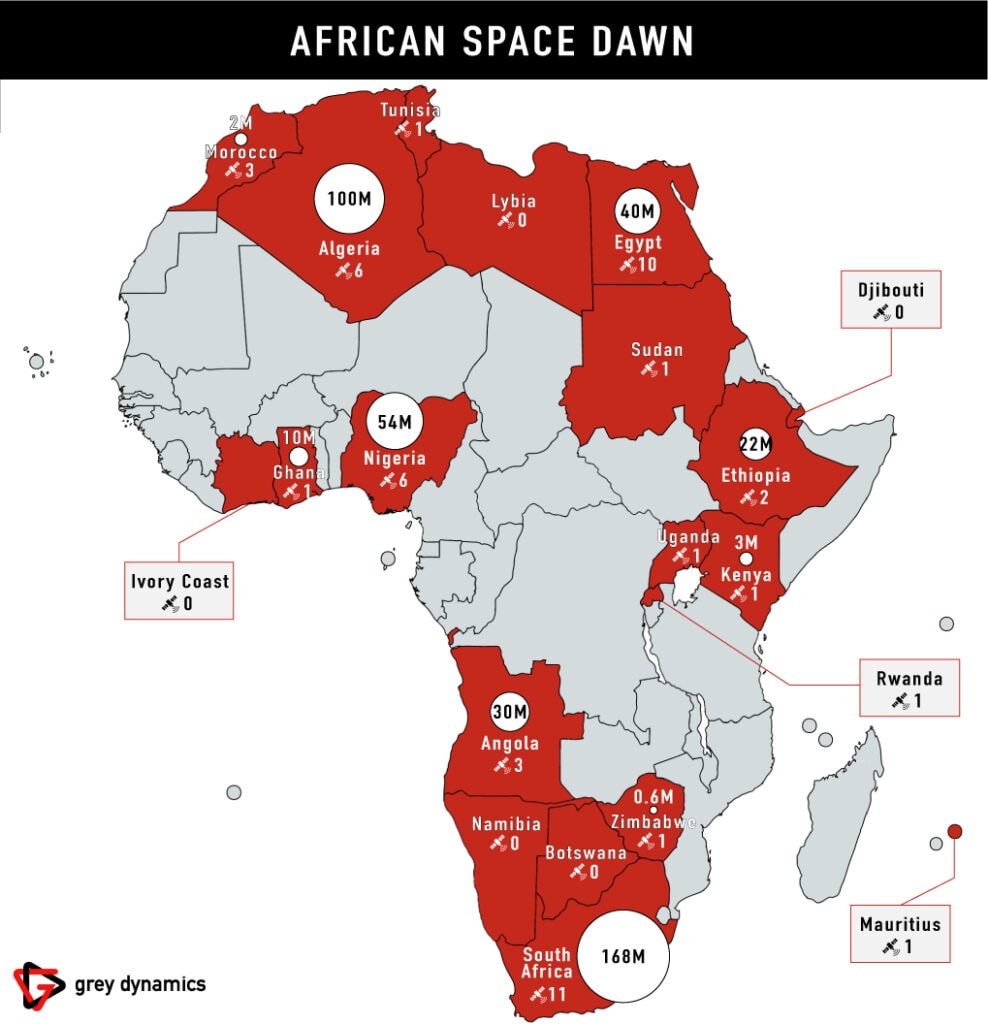

Especially after the 2013 African Union (AU) 2063 strategy’s adoption, the space sector in Africa has experienced a strong development. While the AU formation of the African Space Agency (AfSA) slowly continues, many countries have started national space programmes. South Africa is in the lead, with Egypt, Algeria and Nigeria close behind guiding the growth. Additionally, the market is increasingly profitable even for private firms.

1. Why this matters

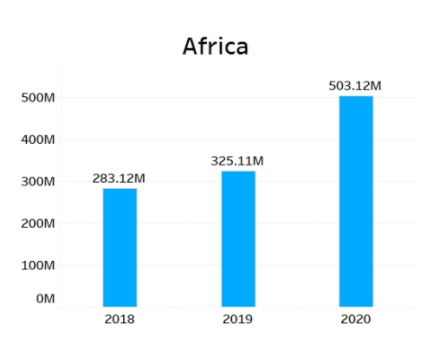

In the last years, the African space market has lived through a boom period:

- In 2021, the sector was worth almost 20 USD billion, and the AU projects it to grow by 16 percent in the next five years. [source]

- With an increase in governmental investment of 80 percent, the African space sector is the fastest growing in the world. [source]

- From 2018 onwards, the number of satellites launched per year almost tripled compared to the time before. [source] Besides this increase, there are plans for more than one hundred new satellite devices in the next three years.

Considering the long-term nature of these investments, the encouraging trends will persist in the next few years. The benefits will concern agriculture, emergency response, natural resources management and communication. Also, as they improve Africans’ life, these developments will render the activities on the continent more profitable, fostering foreign investments.

2. Main applications

The African continent can benefit from space activities in several ways: Communication, Earth Observing (EO) and Intelligence Surveillance and Reconnaissance (ISR) represent the principal dimensions.

- EO, also known as Earth remote sensing satellite, is undoubtedly the most spread type across the continent. These devices collect information about the Earth, such as imagery [source]. Their data is relevant for several sectors directly connected to nature. For instance, in agriculture and mining. Moreover, EO findings are fundamental to measuring climate change consequences and improving emergency response missions.

- Communication (SATCOM): the growth in this area could increase literacy through wider access to educational programmes and news. Besides, improved connectivity will probably render Africa more attractive for foreign industries. [source]

- ISR: Some African forces have used these technologies during conflicts to gain precious information on the adversary. The development of this sector could help states tackle insurgent and terrorist groups. However, the South African Condor-E2 is the only ISR satellite on the continent. [source]

3. Providers

The development of less expensive products (small and nano satellites) is reducing the entry barriers of the space market. This has facilitated the democratisation of the sector, allowing an incredible number of actors to begin space programs or operations. There are three primary categories:

3.1. States

Since the launch of satellite NILE 101 by Egypt in 1998, states have been one of the principal actors in the African space sector. Nowadays, twenty-one countries can boast a space agency, while fifteen of them own at least one satellite. [source] The main usage is EO, while broadband communication remains somewhat secondary [source].

However, African States are rarely autonomous regarding their space program. They often rely on other powers to sponsor, construct, and launch their devices. In particular, China and Russia are among the most prominent partners [source] [source]. Some governments, such as South Africa, perceive this vulnerability and have invested more in domestic infrastructure and production chains.

3.2. Multilateral Initiatives

African Multilateral initiatives in space progress slowly. In late 2017, the AU adopted its spatial strategy and policy [source] [source]. Some months after, the organisation formally created the AfSA. In the strategic documents, AU clarifies the socio-economic focus of its space initiative, recognising that “Space applications are needed to achieve over 90% of [AU] strategic objectives”. Nevertheless, the concrete implementation has been slow. Indeed, while Egypt will host the agency [source], the AU executive council agreed on the structure only one year ago. [source] Even if the operations should start in 2023, there will probably be delays [source].

Another relevant initiative is the African Resource Management Constellation (ARMC). This project among South Africa, Nigeria, Algeria and Kenya was revived in 2018. Led by the South African National Space Agency (SANSA), the programme aims to collect and share EO data through a constellation of satellites. [source]

3.3. Private

The private space market is flourishing. In the last decade, the number of companies has grown exponentially, exceeding the two hundred entities. While the employment impact remains limited (44,670 employees), the economic one is considerable. Indeed, in 2019, the revenues amounted to over 7 USD billion, and they expect it to grow 40 percent by 2024 [source]. These companies often use government infrastructures to deliver their services that are both B2B (business to business) and B2C (business to consumer).

4. What’s next?

While the growth of the African space sector merges, some actors will contribute to shaping this strategic domain’s future.

South Africa’s regional role in the sector is growing. From 2019 to 2021, the country tripled its spatial budget, surpassing Algeria. Besides, SANSA often assumes a leadership function, like in the ARMC project. Finally, the country addresses the spatial dependency issue by sustaining domestic production. The SUNSAT launch by Stellenbosch University makes up a relevant example. [source]

Also, regarding the space industry, China is one of the most prominent partners of the African continent. In particular, it has cooperated with 14 states and the AU. Its relations with Nigeria are long-standing and close. [source] So far, US space commitment on the continent was not strong. However, the US-Africa Space Forum that has taken place 13-15th December 2022, [source] has the potential to increase cooperation significantly.

5. Conclusion

The African outer space sector is booming thanks to cost reduction and increased financial commitment throughout the continent. Several actors, both public and private, are interested in the African Space domain. These developments concern the field of EO, Communication and ISR, potentially benefitting multiple socio-economic facets. The emerging role of South Africa, Chinese influences and US interests will affect the sector growth and international balances.